Welcome to MyExpatSIPP

The SIPP built for expats and non-UK residents

Take control of your UK pension with our online SIPP which is designed specifically to meet the needs of expats and non-UK residents.

No adviser required

FCA authorised & regulated

For expats & non-residents

Putting you in control of your UK pension

The MyExpatSIPP service enables expats and non-UK residents to stay in control of their UK pension and investments from anywhere in the world, without having to use a Financial Adviser.

Transfer a single pension or combine multiple pensions into the easy to manage online SIPP account with complete control over how your pension is invested, together with full support and guidance from our pension experts.

You get full access to your pension from age 55. Keep your pension invested and take withdrawals whenever you want via flexi-access drawdown. You can take lump sums, a regular income, a combination or nothing at all. Withdrawals can even be paid to a non-UK bank account.

Our platform allows you to choose how your money is invested and you can select from:

- UK, US and other overseas Shares

- Exchange Traded Funds

- Investment Trusts

- Unit Trusts & OEICs

- A range of Ready-made Portfolios

Choice Of Currency

You can choose the base currency for your account, the currency of your investments and even the currency of your pension payments.

Support From Experts

We have expert knowledge to assist you with managing your pension in the UK and will explain the options available to you and the implications of being resident overseas.

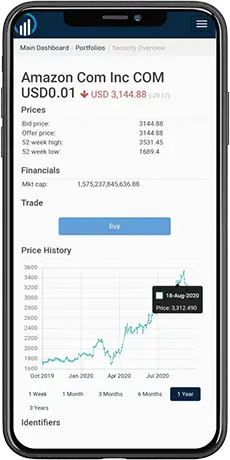

SIPP Platform features

- Online dealing in global Shares, ETFs, Investment Trusts and Mutual Funds

- Live market quotes and instant execution

- Hold investments and cash in multiple currencies

- Track individual investment performance

- Accessible on desktop, tablet and mobile

- Paperless correspondence

- 2-step login for security

Wide range of investment options

As well as offering individual stocks and shares, we offer thousands of Exchange Traded Funds, Investment Trusts, OEICs and Unit Trusts from the world’s leading investment managers.

Here's what our clients have to say

What we offer

SIPP (Self Invested Personal Pension)

What we're known for! An online international SIPP designed for expats to manage your UK pension, giving you control over investments and withdrawals.

ISA (Individual Savings Account)

A savings account with no UK capital gains or income tax on investments held within the account.

JISA (Junior Individual Savings Account)

A savings account for your child with no UK capital gains or income tax on investments held within the account.