Were you mis-sold a QROPS?

QROPS are a different type of foreign pension schemes that receive transfers from UK-registered pension funds. At present, you can transfer into schemes based in your country or residence, however, transferring to a QROPS outside your country of residence will trigger a 25% UK ‘overseas transfer charge’. QROPS in Malta, Gibraltar and the Isle of Man have been sold heavily by offshore financial advisers, often promising significant benefits, but in reality these don’t exist and are no more beneficial than a UK pension scheme. If you have already gone ahead with a QROPS pension transfer, we can help you to transfer to a SIPP so you can take back control of your pension. We will handle the transfer of your pension to ensure it goes as smoothly as possible with minimal fuss.

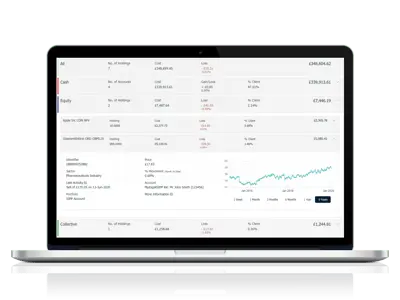

We have helped lots of our clients transfer their pension from these QROPS to our flexible, online SIPP account. A QROPS pension transfer to a SIPP is a simple process and just requires a set of forms to be completed which we can guide you through. An international SIPP may be much more beneficial for you and your pension transfer. From age 55 onwards, you can take 25% of your pension tax free, although this doesn’t have to be taken all at once, it can be paid in instalments as and when required. A SIPP will also allow you to make investment choice by your own account. We offer a much wider range of investments as the HMRC rules allow a SIPP to invest in; mutual funds such as Unit Trusts and OEICs, exchange traded funds (ETFs), investment trusts, direct shares in the UK and overseas and direct corporate and government bonds. If you find that you prefer the benefits and amenities that a SIPP can offer, then get in touch with us for a quick and hassle free QROPS pension transfer.